Are you struggling to secure your family’s future amidst your hectic life?

Estate planning isn’t just about writing a will; it’s a complicated process that requires time and expertise.

You’re already stretched thin, balancing your career, family, and community. This stress leaves little time to focus on your loved ones’ financial security.

You may have tried going the DIY route with legal documents, seeking advice from friends or family, or attending seminars. But legal complexities and ever-changing regulations only left you more confused and unsure about the future.

There is a better way.

Our estate planning law firm has helped countless individuals like you achieve peace of mind by creating comprehensive estate plans tailored to their unique estate planning needs.

With our personalized approach, you’ll finally have a clear path to protect your assets, minimize estate and inheritance taxes, and ensure the well-being of your loved ones.

The result? A secure future and a lasting legacy for your family.

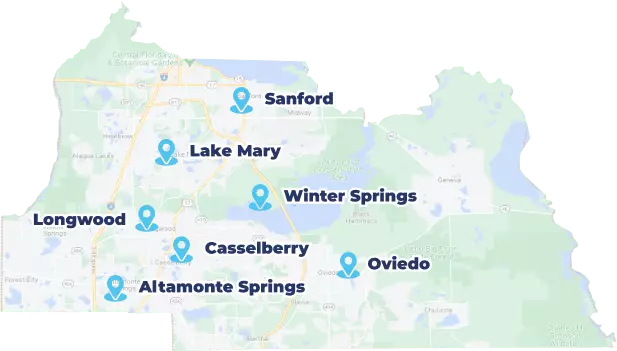

The key to estate planning success is partnering with an experienced Oviedo estate planning lawyer who understands your needs.

Take the first step toward securing your family’s future. Schedule a consultation with our expert estate planning attorney at Vollrath Law in Oviedo today.

People in Florida and throughout the U.S. work hard and save diligently, yet more than half of American adults report they do not have a will or other estate planning documents in place.

An estate plan is for you as much as it’s for those you love. If you die without a will, your assets will be distributed according to the Florida intestate laws, which may not reflect your wishes.

If you have loved ones and any assets, it is important to have a comprehensive estate plan.

A basic estate plan consists of:

At Vollrath Law, we aim to provide our clients with the peace of mind that comes with knowing their assets will be handled as they wish when they die.

When structured properly, an estate plan also ensures that the transfer of assets happens as cost-effectively and efficiently as possible.

When planning for the future, it’s important to ensure that your wishes are carried out, and your loved ones are provided for in the event of your incapacity or passing. Our team of estate planning lawyers in Central Florida is dedicated to helping you achieve peace of mind by providing legal assistance for all your planning needs.

Advance directives are legal documents allowing you to make healthcare and financial decisions in advance in case you cannot do so. Our estate planning attorneys can help you create advance directives, such as living wills and durable power of attorney.

A living will outline your wishes regarding medical treatment and end-of-life care. At the same time, a durable power of attorney authorizes a trusted individual to manage your finances in the event of your incapacity.

If you have minor children or dependents with special needs, it’s important to have a plan in place to ensure their care and protection in the event of your incapacity or passing.

Our guardianship lawyers can assist you in establishing guardianship arrangements to ensure trusted individuals care for your loved ones according to your wishes.

Our Oviedo estate planning lawyers also specialize in creating personalized plans for individuals with special needs. We understand that each person’s situation is unique, and we work with you to develop a plan that meets your specific needs. This may include establishing special needs trusts and other tools to ensure ongoing care and support for your loved ones with special needs.

Creating a will or trust is essential to estate planning. Our experienced attorneys serving Oviedo, FL, can guide you through creating a comprehensive plan that ensures your assets are distributed according to your wishes, and your loved ones are provided for after your passing.

A will outlines your wishes to distribute your assets, while assets owned in a trust can provide ongoing support and protection for your loved ones. We work with you to understand your goals and develop a plan that meets your unique needs.

Our Florida attorney is committed to helping you achieve peace of mind by assisting you with all your planning needs. From advanced directives to guardianship arrangements, special needs planning, and wills and trusts, we are here to guide you every step of the way.

Your estate plan should reflect your life and goals. We will take the time to get to know you and your situation to tailor your estate plan to the unique aspects of your life. A cookie-cutter approach to estate planning will not provide the results you want.

Call our Florida estate planning lawyer or use our online contact form to get the legal counsel you deserve. We will review your situation, answer your questions and recommend an effective strategy that achieves your estate planning objectives.

We can’t wait to help you tackle your legal challenges and achieve your goals! Our first step is to chat with you and really get to know your unique situation. We’ll listen to your concerns, answer any questions you may have, and create a customized legal strategy that meets your needs and goals.

With our strategy in place, we’ll work with you to bring your legal matter to a successful resolution. No matter what legal challenge your family is facing, we’re here to guide you every step of the way.

We understand that legal paperwork can be overwhelming, but we’ll make it easy and stress-free for you. We’ll help you prepare and file any necessary documents, ensuring that everything is accurate and up-to-date.

In some cases, negotiations and mediation can help resolve legal matters without going to court. We’ll work with you to find common ground and reach a resolution that meets your needs and goals.

Our final step is to help you achieve success and move forward with confidence. Whether it’s a finalized estate plan that provides peace of mind, or a successful divorce settlement that protects your interests, we’re dedicated to helping you achieve your goals and thrive in the future.

If you don’t have an estate plan, your assets will be distributed according to Florida’s intestacy laws. These laws dictate who your property will go to if you pass away without a will or other estate planning documents. Typically, your assets will be distributed to your closest living relatives, such as your spouse, children, or parents, in a predetermined order.

Without an estate plan, you also won’t have control over who manages your affairs in the event of your incapacity. This means that a court may appoint a guardian or conservator to make decisions on your behalf which may not align with your wishes.

The cost of estate planning in Florida varies depending on the complexity of your estate and the type of legal services required. Some estate planning attorneys may charge a flat fee for basic estate planning services, while others may charge hourly rates. On average, the cost of estate planning in Florida can range from a few hundred to several thousand dollars.

Both wills and trusts have their benefits in Florida estate planning. Wills are a more traditional option and can be used to outline your wishes to distribute your assets after your passing. On the other hand, trusts can offer more flexibility and privacy in managing your assets and shelter wealth from estate taxes. Ultimately, choosing between a will or trust depends on your situation and goals. Consulting with an experienced estate planning attorney can help determine the best option.

Under Florida probate law, estates valued at $75,000 or less may be able to avoid probate through a simplified process known as “summary administration.” However, estates valued at more than $75,000 are generally subject to probate proceedings. It’s important to consult with an experienced estate planning attorney to determine the best course of action for your specific situation.